Is it a Risk for America that China Holds over $1 Trillion in U.S. Debt?

Opinions: Will China dump U.S. bonds as a trade weapon? Not so fast but Slowly

Many worry that China’s ownership of American debt affords the Chinese economic leverage over the United States. This apprehension, however, stems from a misunderstanding of sovereign debt and of how states derive power from their economic relations. The purchasing of sovereign debt by foreign countries is a normal transaction that helps maintain openness in the global economy. Consequently, China’s stake in America’s debt has more of a binding than dividing effect on bilateral relations between the two countries.

Even if China wished to “call in” its loans, the use of credit as a coercive measure is complicated and often heavily constrained. A creditor can only dictate terms for the debtor country if that debtor has no other options. In the case of the United States, American debt is a widely-held and extremely desirable asset in the global economy. Whatever debt China does sell is simply purchased by other countries. For instance, in August 2015 China reduced its holdings of U.S. Treasuries by approximately $180 billion. Despite the scale, this selloff did not significantly affect the U.S. economy, thereby limiting the impact that such an action may have on U.S. decision-making.

Furthermore, China needs to maintain significant reserves of U.S. debt to manage the exchange rate of the renminbi. Were China to suddenly unload its reserve holdings, its currency’s exchange rate would rise, making Chinese exports more expensive in foreign markets. As such, China’s holdings of American debt do not provide China with undue economic influence over the United States.

Why do countries accumulate foreign exchange reserves?

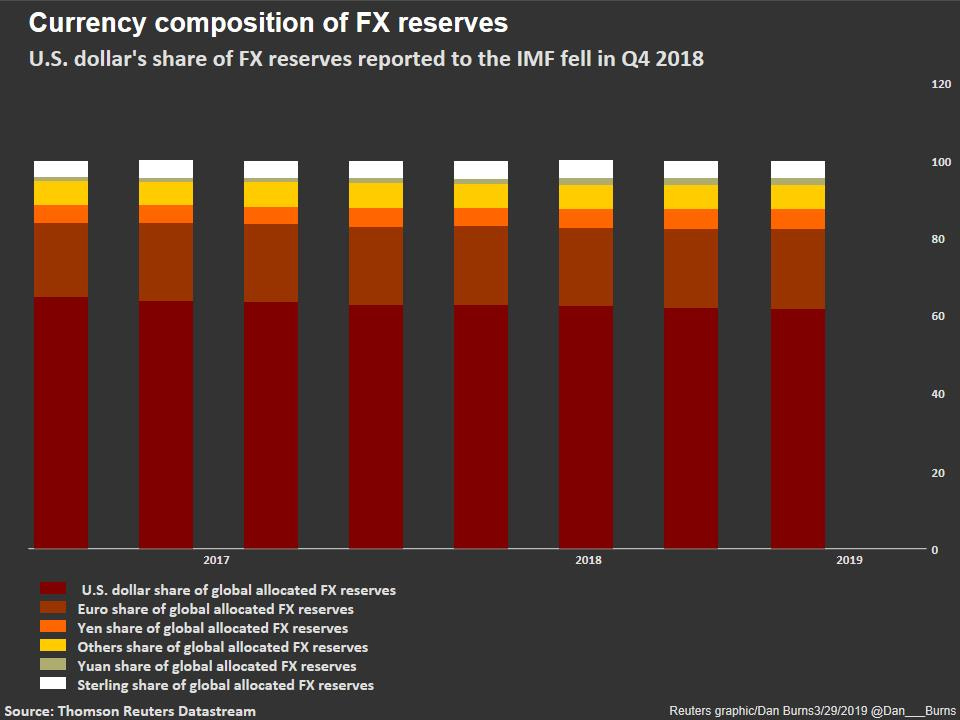

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a country’s central bank. First, sovereign debt frequently comprises part of other countries’ foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

Foreign Reserves

Any country open to international trade or investment requires a certain amount of foreign currency on hand to pay for foreign goods or investments abroad. As a result, many countries keep foreign currency in reserve to pay for these expenses, which cushion the economy from sudden changes in international investment. Domestic economic policies often require central banks to maintain a reserve adequacy ratio of foreign exchange and other reserves for short-term external debt, and to ensure a country’s ability to service its external short-term debt in a crisis. The International Monetary Fund publishes guidelines to assist governments in calculating appropriate levels of foreign exchange reserves given their economic conditions.

Exchange rate

A fixed or pegged exchange rate is a monetary policy decision. This decision attempts to minimize the price instability that accompanies volatile capital flows. Such conditions are especially apparent in emerging markets: Argentinian import price increases of up to 30 percent in 2013 led opposition leaders to describe wages as “water running through your fingers.” Since price volatility is economically and politically destabilizing, policymakers manage exchange rates to mitigate change. Internationally, few countries’ exchange rates are completely “floating,” or determined by currency markets. To manage domestic currency rates, a country might choose to purchase foreign assets and store them for the future, when the currency might depreciate too quickly.

A low-risk store of value

As sovereign debt is government-backed, private and public financial institutions view it as a low-risk asset with a high chance of repayment. Some government bonds are seen as riskier than others. A country’s external debt may be viewed as unsustainable relative to its GDP or its reserves, or a country could otherwise default on its debt. Generally, however, sovereign debt is more likely to return value and therefore is safer relative to other forms of investment, even if earned interest is not high.

Why does China buy U.S. debt?

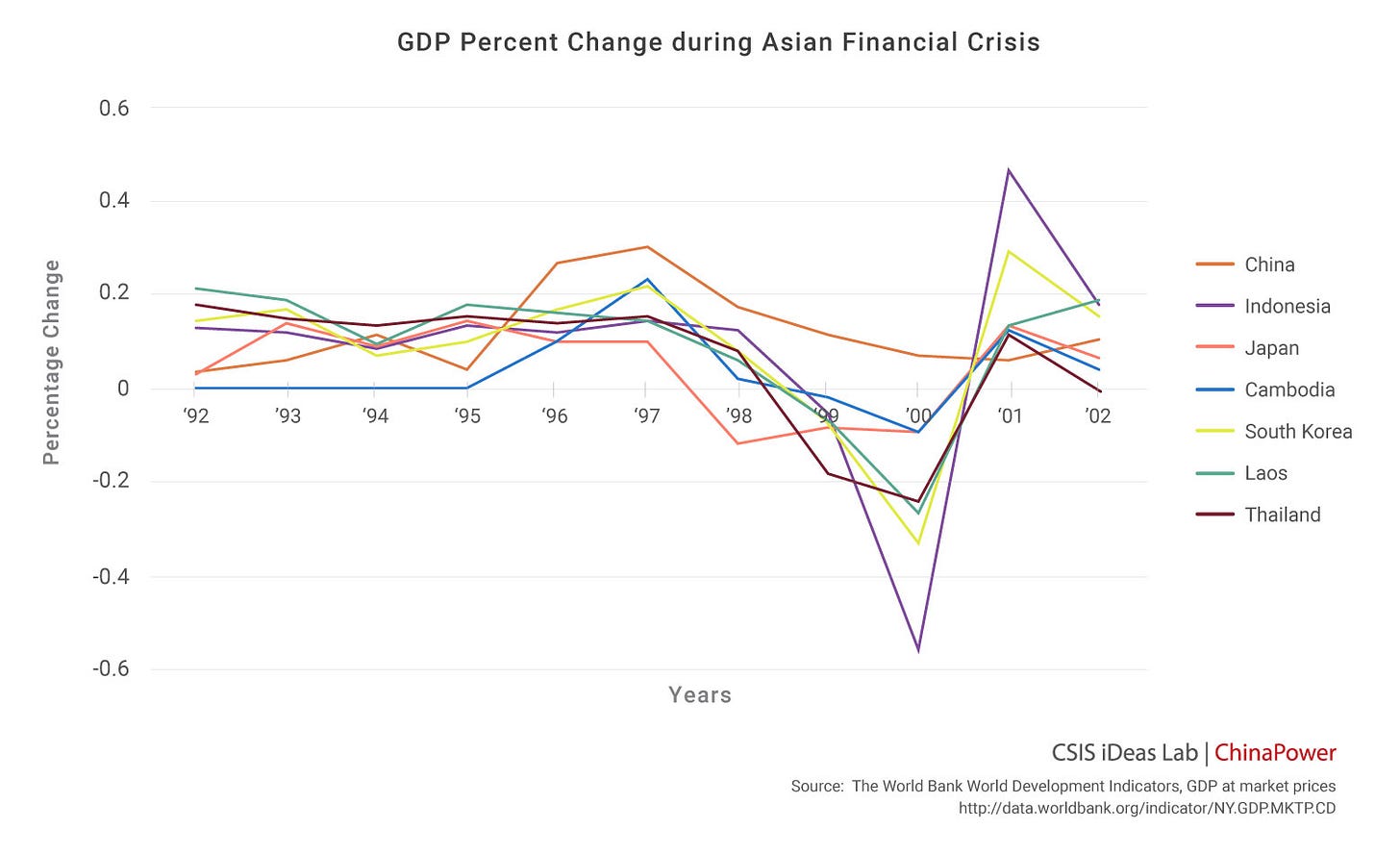

China buys U.S. debt for the same reasons other countries buy U.S. debt, with two caveats. The crippling 1997 Asian Financial Crisis prompted Asian economies, including China, to build up foreign exchange reserves as a safety net. More specifically, China holds large exchange reserves, which were built up over time due in part to persistent surpluses in the current account, to inhibit cash inflows from trade and investment from destabilizing the domestic economy.

China’s large U.S. Treasury holdings say as much about U.S. power in the global economy as any particularity of the Chinese economy. Broadly speaking, U.S. debt is an in-demand asset. It is safe and convenient. As the world’s reserve currency, the U.S. dollar is extensively used in international transactions. Trade goods are priced in dollars and due to its high demand, the dollar can easily be cashed in. Furthermore, the U.S. government has never defaulted on its debt.

Despite U.S. debt’s attractive qualities, continued U.S. debt financing has concerned economists, who worry that a sudden stop in capital flows to the United States could spark a domestic crisis. Thus, U.S. reliance on debt financing would present challenges—not if demand from China were halted, but if demand from all financial actors suddenly halted.

From a regional perspective, Asian countries hold an unusually large amount of U.S. debt in response to the 1997 Asian Financial Crisis. During the Asian Financial Crisis, Indonesia, Korea, Malaysia, the Philippines, and Thailand saw incoming investments crash to an estimated -$12.1 billion from $93 billion, or 11 percent of their combined pre-crisis GDP.3 In response, China, Japan, Korea, and Southeast Asian nations maintain large precautionary rainy-day funds of foreign exchange reserves, which—for safety and convenience—include U.S. debt. These policies were vindicated post-2008, when Asian economies boasted a relatively speedy recovery.

From a national perspective, China buys U.S. debt due to its complex financial system. The central bank must purchase U.S. Treasuries and other foreign assets to keep cash inflows from causing inflation. In the case of China, this phenomenon is unusual. A country like China, which saves more than it invests domestically, is typically an international lender.

To avoid inflation, the Chinese central bank removes this incoming foreign currency by purchasing foreign assets—including U.S. Treasury bonds—in a process called “sterilization.” This system has the disadvantage of generating unnecessarily low returns on investment: by relying on FDI, Chinese firms borrow from abroad at high interest rates, while China continues to lend to foreign entities at low interest rates.5 This system also compels China to purchase foreign assets, including safe, convenient U.S. debt.

Who owns the most U.S. debt?

Around 70 percent of U.S. debt is held by domestic financial actors and institutions in the United States. U.S. Treasuries represent a convenient, liquid, low-risk store of value. These qualities make it attractive to diverse financial actors, from central banks looking to hold money in reserve to private investors seeking a low-risk asset in a portfolio.

Of all U.S. domestic public actors, intragovernmental holdings, including Social Security, hold over a third of U.S. Treasury securities. The secretary of the treasury is legally required to invest Social Security tax revenues in U.S.-issued or guaranteed securities, stored in trust funds managed by the Treasury Department.

The Federal Reserve holds the second-largest share of U.S. Treasuries, about 13 percent of total U.S. Treasury bills. Why would a country buy its own debt? As the U.S. central bank, the Federal Reserve must adjust the amount of money in circulation to suit the economic environment. The central bank performs this function via open market operations—buying and selling financial assets, like Treasury bills, to add or remove money from the economy. By buying assets from banks, the Federal Reserve places new money in circulation in order to allow banks to lend more, spur business, and help economic recovery.

Excluding the Federal Reserve and Social Security, a number of other U.S. financial actors hold U.S. Treasury securities. These financial actors include state and local governments, mutual funds, insurance companies, public and private pensions, and U.S. banks. Generally speaking, they will hold U.S. Treasury securities as a low-risk asset.

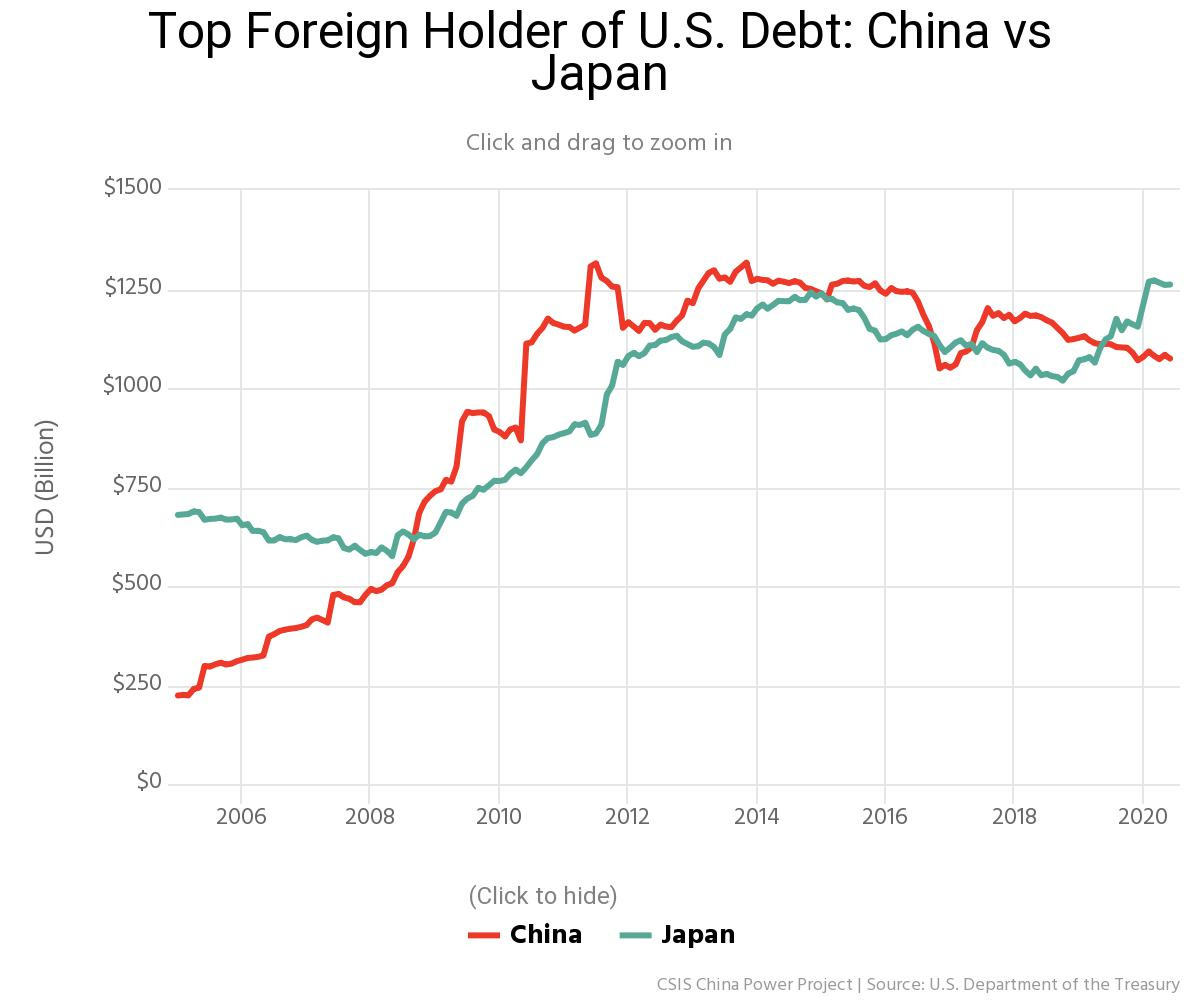

Overall, foreign countries each make up a relatively small proportion of U.S. debt-holders. Although China’s holdings have represented just under 20 percent of foreign-owned U.S. debt in the past several years, this percentage only comprises between 5 and 7 percent of total U.S. debt. China’s holdings fell to $1.05 trillion in November 2016, marking the lowest level since 2010. Moreover, Japan has at times overtaken China as the largest foreign holder of U.S. debt. This has been the case since June 2019, as China’s holdings have fallen and Japan’s have risen.

Internationally, this situation is common: most sovereign debt is held domestically. European financial institutions hold the majority of European sovereign bonds. Similarly, Japanese domestic financial actors hold approximately 90 percent of Japanese net sovereign debt. Thus despite international demand for U.S. sovereign debt, the United States is no exception to the global trend: U.S. domestic actors hold the majority of U.S. sovereign bonds.

Will China dump U.S. bonds as a trade weapon? Not so fast

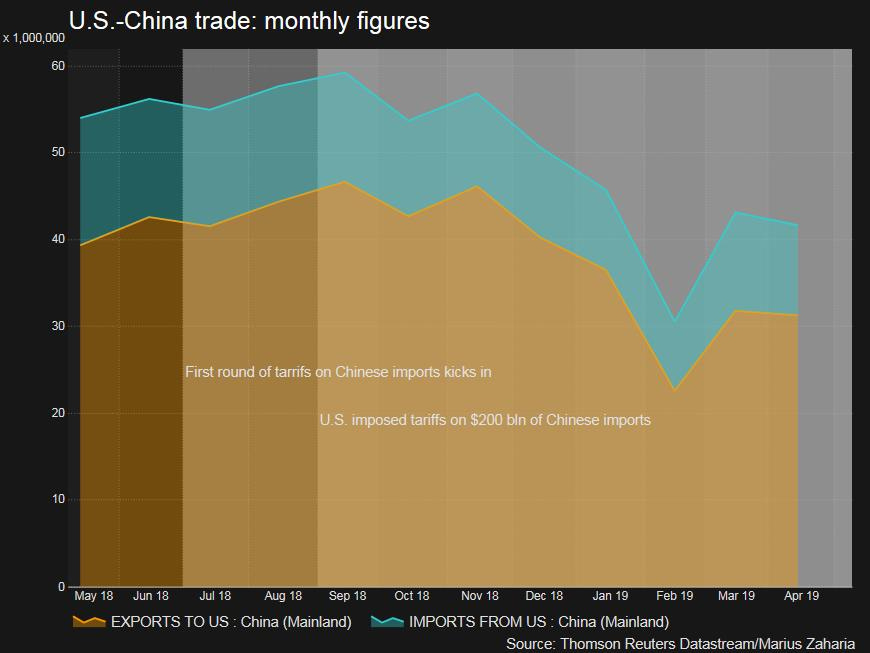

The trade war between Beijing and Washington has stoked concern in financial markets that China might opt to weaponize its holdings of more than $1.1 trillion worth of U.S. Treasuries in retaliation for the tariffs the Trump administration has imposed on Chinese imports.

Often referred to as the “nuclear option,” choosing to dump so large a pool of assets would likely destabilize world financial markets, drive interest rates higher and push tensions between the world’s two largest economies into uncharted territory.

China has been slimming its Treasury securities portfolio for some time, but most analysts see an aggressive reduction of its holdings as a remote possibility at most. There is no evidence Beijing is seriously looking to flood markets with its U.S. bonds.

HOW MUCH U.S. DEBT DOES CHINA OWN?

About a decade ago, China overtook Japan as the largest foreign holder of U.S. government debt.

Its holdings stood at more than $1.12 trillion at the end of March, according to U.S. Treasury department data. Japan is a close second with nearly $1.08 trillion. China’s holdings peaked in late 2013 at nearly $1.32 trillion and have come down by about 15% since then. In March they were the lowest in about two years. Its share of the Treasury market has fallen even faster, due to the steady issuance of U.S. debt required to finance the growing federal budget deficit.

The world’s second biggest economy owns about 7% of the $16.18 trillion of U.S. public debt outstanding, its lowest share in 14 years, and down from a peak of 14% in 2011. Still, its slice of the pie is exceeded only by the U.S. Federal Reserve, which owns $2.15 trillion of Treasuries, or 13.5% of the market. Treasury issuance is expected to keep accelerating following a massive tax cut enacted in December 2017, so China’s share of the market will likely drop even further.

WHAT IS THE RISK TO THE UNITED STATES IF CHINA SELLS?

Most analysts agree that large-scale selling by Beijing would disrupt the Treasury market and other markets.

An abrupt shift in the balance of supply and demand could drive down Treasury prices, and drive up their yields, which move in the opposition direction to prices.

That would cause a spike in borrowing costs for the U.S. government. Also, because Treasury yields are a benchmark for U.S. consumer and business credit, interest rates on everything from corporate bonds to homeowners’ mortgages would rise, likely slowing the economy. Such a jarring move would also erode global investors’ confidence in the U.S. dollar as the world’s top reserve currency.

WHAT IS THE RISK TO CHINA IF IT DUMPS TREASURIES?

Most analysts argue China has not opted to sell Uncle Sam’s IOUs because a nosedive in U.S. bond prices also would bring down the value of China’s remaining Treasury holdings. Also, China’s currency, the yuan, is not fully free floating. Beijing uses its Treasury holdings as a key tool to stabilize the yuan within a targeted range, against the dollar in particular.

Some critics have alleged China uses Treasuries and its other currency reserves to hold down the yuan, making its exports more attractive. At the same time, allowing the currency to cheapen too much risks other problems, such as foreign capital flight.

Any sharp depreciation in the greenback might force Beijing to defend the yuan, which may mean shedding more of its Treasuries stake. Back in 2016, China’s Treasuries holdings fell sharply by some $200 billion from May to November of that year as the yuan depreciated on worries about the Chinese economy. Lastly, any knock-on effect in the U.S. economy would also be felt in China because the United States is the destination for nearly a fifth of Chinese exports.

In next issue, I would write about How Long Can US Government Debts Sustain?

Buying into US share is like owning US sovereign debt. and mentioning about historical of US and Japan domestic owning its own sovereign debt the most, are u expecting US going to repeat as their step? As US is robbing whole world by everybody owning . If China need to dominate, it need to have strategy to save the others countries too from massive declination of USD?? bloomed my mind again.. GG.com